What is a Proprietorship?

A Proprietorship, also known as a Sole Proprietorship, is the simplest and most common form of business structure, particularly suited for small and individual-run businesses. In this model, a single person owns, manages, and controls the entire operation. It is not a separate legal entity, meaning the owner is personally responsible for all liabilities and debts of the business. This type of business is easy to start, requires minimal compliance, and offers complete control to the owner. Sole proprietorships are widely used in India, especially in the unorganized sector by shopkeepers, freelancers, and small service providers. However, the major drawback is that the owner’s personal assets are not protected if the business incurs losses. Despite this, it remains a popular choice for first-time entrepreneurs and businesses with limited capital and low risk

What is the prominence of online registration of a sole proprietorship firm in India?

A sole proprietorship is the simplest form of business in India, owned and managed by a single person. To start it officially, you need to complete the online proprietorship firm registration, which is essential for opening a current bank account in the business name. This type of registration is highly popular among new entrepreneurs because it involves low cost, minimal compliance, and simple procedures, allowing them to start their venture quickly and easily. While the proprietor enjoys full control over the business, it is important to note that they also bear all liabilities. Overall, sole proprietorship registration is a golden opportunity for beginners who want to establish their business with maximum ease and flexibility.

What are the benefits of registering and starting a business as a sole proprietorship in India

Registering a sole proprietorship in India offers several practical benefits for new and small business owners. It’s one of the easiest and most affordable business structures to start, with minimal paperwork and low compliance requirements. You don’t need to register as a company or file complex legal documents—basic registrations like GST, Shop & Establishment Act, and MSME (Udyam) are enough to get started.

The sole proprietor has full control over business decisions and enjoys complete ownership of profits. Taxation is also simpler—income is taxed as personal income, and small businesses can opt for the presumptive taxation scheme under Section 44AD to avoid detailed bookkeeping.

With registrations like GST or MSME, the business gains credibility, making it easier to open a current bank account and access loans, subsidies, and government schemes. Compliance and annual maintenance are minimal, and closing the business is far easier than shutting down a company or LLP.

Overall, it’s a flexible, low-risk structure ideal for freelancers, consultants, small traders, and anyone starting out on their entrepreneurial journey.

Make Appointment

Recommended Additional Registrations

While a sole proprietorship has minimal regulatory requirements, certain registrations may be necessary depending on the nature of the business:

MSME Registration: The Udyog Aadhaar or MSME registration can be obtained for the business to establish its recognition with the Ministry of Micro, Small, and Medium Enterprises.

TAN Registration: If the proprietor is required to deduct TDS (Tax Deducted at Source) while making salary payments, they must obtain a Tax Deduction and Collection Account Number (TAN) from the Income Tax Department.

GST Registration: If the business’s annual turnover exceeds the GST threshold limit (Rs. 20 lakhs for services and Rs. 40 lakhs for goods), GST registration becomes mandatory.

Import Export Code (IEC): For businesses involved in the import or export of goods, obtaining an Import Export Code (IEC) from the Directorate General of Foreign Trade (DGFT) is required.

FSSAI Registration: For businesses involved in the food industry, whether selling or handling food products, registration with the Food Safety and Standards Authority of India (FSSAI) is required.

Wrap-Up

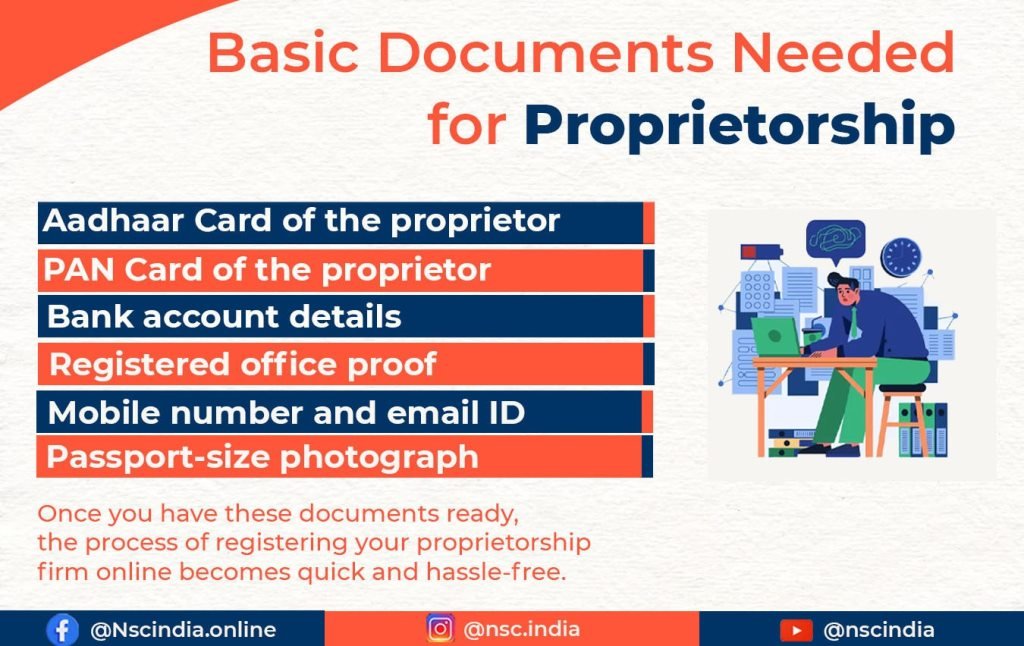

Once the required documents are ready and legal formalities are completed, your sole proprietorship business can officially begin. With the right strategies, proper tax awareness, and compliance, you can smoothly grow your business and move it in the right direction.